The Ultimate Guide to Importing from China: Steps to Success

Importing from China can be a game-changer for your business—if you do it right.

From finding reliable suppliers to understanding customs requirements, there’s a lot to manage. But don’t worry; you’re not alone.

This comprehensive guide will take you through every step of the process, helping you avoid pitfalls and maximize profits.

Whether you’re looking to source unique products or scale your operations, we’ll show you how to import like a pro.

15 Steps to Successfully Import from China

Here are 15 key steps you need to take to import from China.

Step 1: Select the right products to import

Your import journey begins with deciding what to import. This step is critical because the products you choose will determine your profitability and compliance requirements.

Here are the key factors to consider when selecting products:

- Market demand: Research what’s trending and in demand using tools like Google Trends, Amazon Bestsellers, and e-commerce platforms.

- Profit margins: Calculate the potential selling price against your costs, including production, shipping, and duties, to ensure the product is profitable.

- Your expertise: Choose a product category you understand well or feel confident marketing to leverage your knowledge effectively.

- Regulatory compliance: Avoid restricted or regulated items such as alcohol and pharmaceuticals unless you have the proper licenses.

Note: Import regulations vary by country. Always consult the specific import guidelines of your destination country to ensure compliance.

Step 2: Understand your import rights

After identifying a product, the next step is ensuring you have the legal authority to import it into your country. This ensures your business is compliant and avoids delays or penalties during customs.

Here’s what you need to know about import rights in key regions:

-

- United States: You must obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) if you plan to import goods for commercial purposes.

- European Union: You must register for an Economic Operator Registration and Identification (EORI) number.

- Canada: A Business Number from the Canada Revenue Agency is required for commercial imports. You may also require an import or export permit from specific government agencies for certain goods.

- Australia: While no import license is needed for most goods, you might need to obtain permits to clear certain imported goods from customs control.

- Brazil: You must register with the Brazilian Federal Revenue (Receita Federal) to obtain a RADAR license, which allows you to import goods.

- Mexico: You must be registered with the Official Register of Importers, compliance with customs regulations, and have proper documentation. Sector-specific imports, like textiles, need additional registration and advance shipment notice.

Pro Tip: Consider hiring a customs broker to assist in navigating complex importation regulations.

Step 3: Engage a sourcing agent

After identifying the type of products you want to import, you need a strategy to find reliable suppliers.

Engaging a sourcing agent can simplify the journey.

This step is especially important if you’re new to importing, importing large quantities, or dealing with specialized goods.

Sourcing agents act as your representatives in China, leveraging their expertise to:

- Vet suppliers: Ensure suppliers are legitimate, reliable, and capable of meeting your specifications.

- Negotiate terms: Secure the best prices and favorable payment or Minimum Order Quantity (MOQ) terms.

- Manage quality control: Oversee inspections at every stage, from sampling to pre-shipment checks.

- Facilitate communication: Bridge language and cultural gaps to avoid misunderstandings.

- Streamline logistics: Coordinate order placement, production timelines, and shipping arrangements.

Using a sourcing agent offers multiple benefits:

- Saves time: They manage the labor-intensive aspects of finding and negotiating with suppliers.

- Reduces risk: Agents have established networks and experience, reducing the chances of scams or receiving low-quality goods.

- Simplifies compliance: They often have knowledge of regulations and certifications needed for your products in different countries.

- Improves efficiency: Sourcing agents streamline the process so you can focus on core business operations.

East West Basics is a leading sourcing agent with over 25 years of experience. We specialize in connecting businesses with trusted manufacturers in China and across Asia.

With 50+ experts and access to 1000+ vetted factories, we handle everything from supplier vetting to logistics and quality control.

Trusted by brands like Walmart, Target, and QVC, we offer tailored solutions to simplify your importing process.

Pro Tip: When hiring a sourcing agent, check their track record, request references, and clarify their fees upfront.

Step 4: Identify potential quality issues

Before committing to an order, it’s vital to address any potential quality concerns. Quality issues can disrupt your supply chain, damage your brand’s reputation, and result in customer dissatisfaction.

Taking proactive measures ensures your products meet your standards and customer expectations.

Here are some steps to identify and resolve quality issues:

- Inspect product samples: Always request samples before bulk production. Test them for consistency, durability, and compliance with your specifications.

- Research supplier track records: Review customer feedback, ratings, and transaction history to identify patterns of quality issues. Use platforms like Alibaba or Made-in-China for verified reviews.

- Set clear quality benchmarks: Document your requirements in detail—materials, dimensions, and tolerances. Include these benchmarks in your contract to avoid ambiguity.

- Conduct factory audits: Hire third-party inspectors to assess the supplier’s manufacturing processes, capacity, and adherence to industry standards.

- Schedule in-process inspections: Check the production line mid-cycle to catch quality concerns early and avoid surprises during shipment.

Your sourcing agents will be essential in your quality testing process, so make sure you communicate your quality expectations clearly.

Pro Tip: Don’t just inspect product samples visually; test them in real-world conditions similar to how your customers will use them. For instance, if you’re importing electronics, check their performance under different voltage conditions. If it’s apparel, wash and wear the samples to evaluate durability and comfort. Real-use testing uncovers potential flaws that might not be obvious at first glance.

Step 5: Ensure compliance

Once you’ve confirmed product quality, the next step is ensuring your goods meet your target market’s legal and regulatory requirements.

Each country has its own regulations regarding imported goods. Failing to meet these standards can result in fines, confiscated shipments, or even a ban on future imports.

To ensure compliance, follow these steps:

- Check certification requirements: Determine the certifications needed for your product in your target market. For instance:

- CE Mark: Required for electronics sold in the EU.

- FCC Certification: Mandatory for U.S. electronic devices.

- ISO Standards: Verify quality management systems.

- Conduct product testing: Test initial samples for safety, functionality, and durability. High-risk products may require third-party lab testing to meet regulatory standards.

- Ensure proper labeling: To comply with local regulations, labels must include the product name, country of origin, safety certifications, and usage instructions.

Pro Tip: Discuss compliance requirements with your supplier early to avoid last-minute adjustments or delays.

Step 6: Classify your goods and determine tariffs

Once compliance has been verified, the next step is to assign your products the correct Harmonized System (HS) Code. This code dictates the duties and taxes you’ll pay during customs clearance.

Misclassification can lead to fines, delays, or even the seizure of goods. Accurate classification ensures you pay the right duties and speeds up customs processing.

Here’s how you can classify your goods:

- Consult your supplier: Many suppliers can provide an HS Code for their products.

- Use government tools: Customs authorities often have online HS Code lookup tools based on product descriptions.

- Hire a customs broker: If you’re uncertain, a broker can help you assign the right code.

Tariff Calculation Example

Let’s say you’re importing LED lights:

| Description | HS Code | Tariff Rate |

| LED Light Bulbs | 8539.50.00 | 5% |

Pro Tip: To streamline the process, keep detailed records of your products’ HS Codes for future shipments.

Step 7: Calculate the total landed cost

Before placing your order, you need to know the total landed cost. This is the complete expense of bringing goods from the supplier’s factory to your warehouse. This helps you set profitable pricing and avoid surprises.

Landed cost is a sum of all expenses involved in delivering your goods, including:

- Product cost: The price paid to the supplier.

- Shipping fees: Costs for air, sea, or courier services.

- Customs duties and taxes: Based on HS Code and trade agreements.

- Insurance: Covers damage, loss, or theft during transit.

- Inland Transportation: Moving goods from the port to your warehouse.

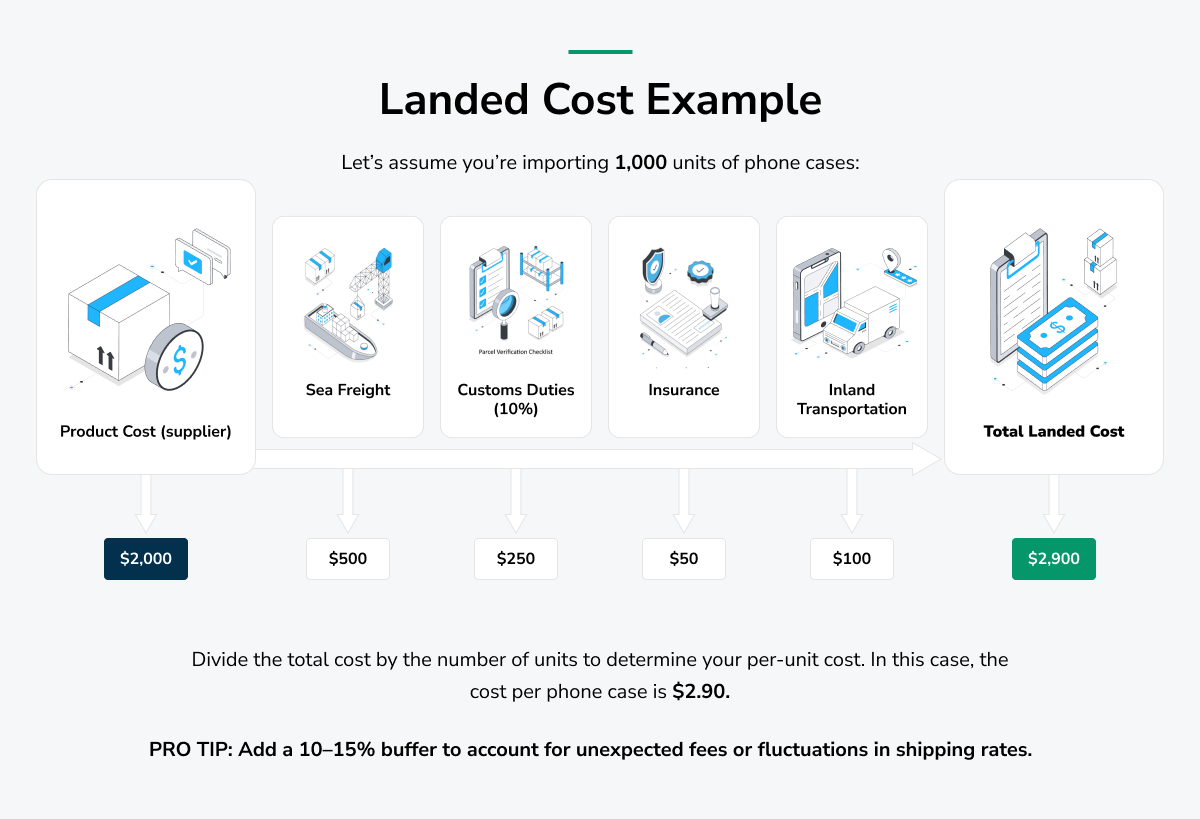

Landed Cost Example

Let’s assume you’re importing 1,000 units of phone cases:

| Expense | Amount |

| Product Cost (supplier) | $2,000 |

| Sea Freight | $500 |

| Customs Duties (10%) | $250 |

| Insurance | $50 |

| Inland Transportation | $100 |

| Total Landed Cost | $2,900 |

Divide the total cost by the number of units to determine your per-unit cost. In this case, the cost per phone case is $2.90.

Pro Tip: Add a 10–15% buffer to account for unexpected fees or fluctuations in shipping rates.

Step 8: Place your order and negotiate terms

Now that you’ve calculated costs and prepared for compliance, it’s time to formalize your order with the supplier. This step ensures mutual understanding and sets the foundation for production and delivery.

Follow these steps to ensure a smooth ordering process:

- Agree to the terms in a proforma invoice (P/I): This document confirms all the details of your order, including product descriptions, quantities, unit prices, shipping terms, and payment schedules.

- Include incoterms in P/I: International Commercial Terms (Incoterms) define who is responsible for costs and risks at different stages of transit. Common terms include:

- FOB (Freight on Board): The supplier delivers goods to the port, and you handle shipping costs and risks from there.

- CIF (Cost, Insurance, Freight): The supplier pays for shipping and insurance until the goods reach the destination port, but you handle costs from there.

- DDP (Delivered Duty Paid): The supplier covers all costs, including import duties, delivering goods directly to your warehouse.

- Negotiate payment terms: Discuss payment schedules. For larger or repeat orders, you can try to negotiate staggered payments or extended credit terms.

- Confirm customization requirements: Clearly outline any branding, packaging, or labeling needs. Request a sample of the customized product before production begins to ensure accuracy and quality.

- Agree on production timelines: Set clear deadlines for manufacturing, quality inspections, and shipping to align with your delivery schedule and avoid delays.

A sourcing agent, like East West Basics, can simplify this step by negotiating favorable terms, ensuring clear communication of your requirements, and monitoring progress, saving you time and reducing risks.

Step 9: Arrange logistics and transportation

Once your order is placed, the next step is organizing the transportation of your goods. This step is essential for ensuring your products move efficiently, safely, and in compliance with regulations from the supplier’s facility to your warehouse.

Take these steps to arrange logistics and transportation:

- Choose the right shipping method:

- Air freight: Best for urgent, small shipments; fast but pricey.

- Sea freight: Great for bulk shipments; affordable but slow.

- Courier services: Convenient for small packages; direct but costly.

- Rail freight: Good for areas with train networks; cost-effective and moderate speed.

- Hire a freight forwarder: Freight forwarders manage shipping logistics on your behalf. They handle:

- Coordination between suppliers, carriers, and customs.

- Required export and import documentation.

- Real-time updates on shipment progress.

- Secure insurance: Shipping insurance protects your goods against damage, theft, or loss during transit. The cost of insurance is typically a small percentage of the shipment value but can save you significant losses.

- Arrange inland transportation: Once the shipment arrives at the destination port, plan for the final leg of transportation. This might involve trucking the goods from the port to your warehouse or distribution center.

Pro Tip: Compare shipping quotes from multiple logistics providers to find the best balance between cost and reliability. Also, plan for potential delays due to customs inspections, port congestion, or bad weather.

Step 10: Prepare and submit customs documentation

Customs clearance is one of the most important steps in the import process. Without the proper documentation, your shipment can be delayed, incur fines, or even be confiscated.

Preparing and submitting accurate paperwork ensures your goods clear customs smoothly.

Here is key customs documentation you will need to have:

- Commercial invoice: Include details about the transaction, such as product descriptions, quantities, unit prices, and terms of sale. This document serves as the basis for customs valuation.

- Packing list: Provide a detailed breakdown of the shipment, including the weight, dimensions, and content of each package. This helps customs identify and inspect goods.

- Bill of lading (B/L) or Air waybill: These serve as proof of shipment and indicate ownership of the goods. The type of document depends on your shipping method.

- Certificate of origin: This verifies where the goods were manufactured. If your country and China have a favorable trade agreement, this may reduce duties.

- Import permits (if required): Check whether your goods need special licenses or permits to enter your country.

- HS code documentation: Include the correct Harmonized System Code to ensure duties and tariffs are calculated accurately.

Pro Tip: Collaborate with a customs broker to double-check all documentation and submit it well before your shipment arrives to avoid delays.

Step 11: Clear customs and pay duties

Clearing customs is the final hurdle before receiving your goods. This step ensures that all regulatory requirements are met and that duties and taxes are paid.

Follow these steps to clear customs:

- Submit required documents: Provide the commercial invoice, packing list, bill of lading, and other supporting paperwork.

- Pay duties and taxes: Customs calculates these fees based on your HS Code, declared value, and trade agreements. Payment must be made before goods are released.

- Arrange for inspection: Customs may randomly inspect shipments to verify that the declared goods match the documentation. To avoid complications, ensure the shipment complies with regulations.

- Release of goods: Once all documentation and payments are processed, customs will release your goods for pickup or onward transportation.

Pro Tip: Work closely with your freight forwarder or customs broker to expedite the clearance process and resolve any issues promptly.

Step 12: Track and receive your shipment

Tracking the progress of your goods after they clear customs ensures you’re ready to receive and inspect them upon arrival.

Tracking allows you to anticipate potential delays and coordinate with logistics providers for final delivery.

Here are some ways you can track your shipment:

- Freight forwarder updates: Freight forwarders typically provide real-time updates on the shipment’s location and status.

- Courier portals: If you’re using a courier service like DHL or FedEx, use their online tracking systems for detailed information.

- Direct communication: Stay in touch with your supplier or logistics provider for additional updates.

Pro Tip: To account for delays, build a buffer into your delivery timelines, especially during peak shipping seasons.

Step 13: Inspect goods upon arrival

Once your shipment arrives at your warehouse or distribution center, inspect it immediately to confirm it meets your expectations. Early inspections allow you to address issues promptly with your supplier.

Use this inspection checklist:

- Quality control: Verify the goods match the agreed specifications and sample quality.

- Quantity check: Ensure the shipment contains the correct number of units.

- Damage assessment: Look for signs of damage caused during transit and document them with photos and written reports.

- Compliance verification: Double-check that all labels, certifications, and documentation align with regulatory requirements.

If you identify any discrepancies or damage, notify your supplier immediately to negotiate a resolution.

Step 14: Manage inventory and distribution

Once your goods pass inspection, effective inventory management ensures timely fulfillment and keeps your supply chain running smoothly.

Here are some best practices for managing inventory:

- Organize storage: Arrange goods systematically, using labels and categories to streamline access.

- Use inventory software: Implement a system that tracks stock levels, reorder points, and sales trends in real-time.

- Coordinate distribution: Work with logistics providers to ensure timely delivery to customers or retailers.

- Maintain safety stock: Keep a buffer of inventory on hand to prevent disruptions during unforeseen delays or demand spikes.

Step 15: Evaluate and optimize the import process

The final step in your importing journey is reviewing the entire process. This evaluation ensures continuous improvement and greater efficiency for future shipments.

Here’s how to evaluate and optimize:

- Review supplier performance: Assess whether the supplier met expectations for quality, timelines, and communication.

- Analyze cost accuracy: Compare actual landed costs against your initial estimates. Identify any unexpected expenses and plan to mitigate them in the future.

- Assess logistics efficiency: Evaluate whether your chosen shipping methods, freight forwarders, and customs brokers performed well.

- Gather customer feedback: If your goods are already in the market, listen to customer feedback about product quality and delivery times.

- Identify bottlenecks: Determine which parts of the process were slow or prone to errors and implement changes to streamline operations.

Pro Tip: Keep detailed records of each shipment, including supplier contracts, logistics performance, and cost breakdowns. This data will help you refine your strategy and scale your operations effectively.

Conclusion

Importing from China can be challenging, but with a clear plan and the right support, the process becomes far more efficient and successful. Schedule a free 30-minute consultation with East West Basics, and let us guide you as your trusted sourcing partner every step of the way.